Everything about Irs Tax Notifications

Wiki Article

The Facts About Corporate Structuring Uncovered

Table of ContentsThe Facts About Protecting Assets After Assessment RevealedThe Ultimate Guide To Tax PlanningAccounting Services Can Be Fun For AnyoneRumored Buzz on Examination / Audit HelpGet This Report about Examination / Audit HelpThe Greatest Guide To Corporate Restructuring

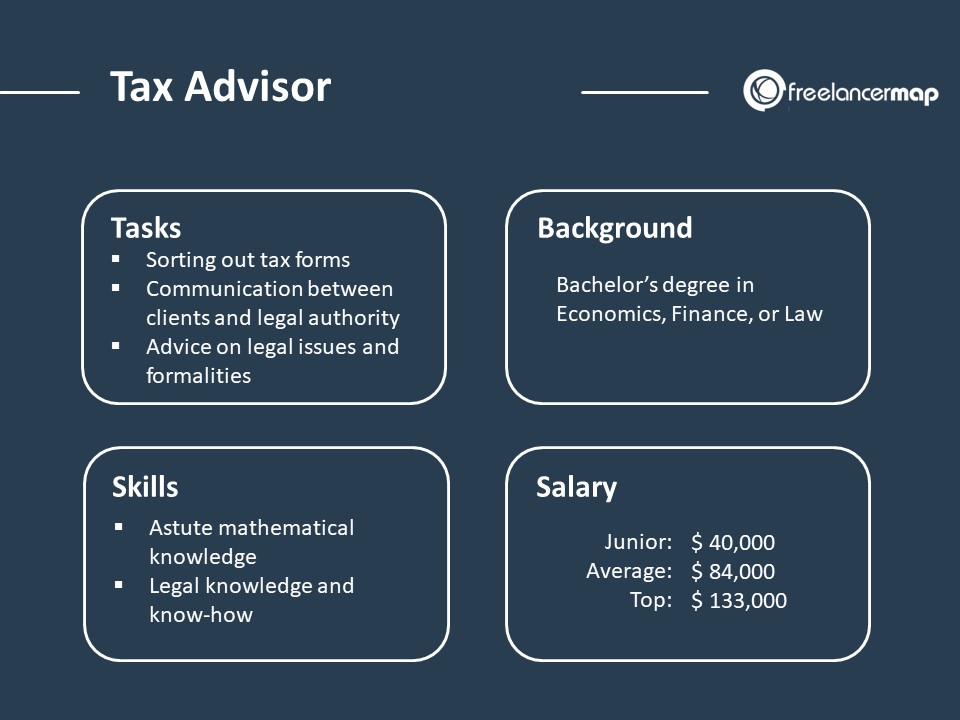

Commonly attributed to Ben Franklin is this popular quote:"Absolutely nothing is specific other than for death and also taxes." Many individuals discover tax problems to be confusing and difficult, and, as opposed to doing their very own taxes, they commonly choose to hire an expert (Protecting Assets After Assessment). Taxpayers that have substantial assets or complicated personal funds, may opt to work with a tax obligation expert, who can leverage her thorough knowledge and experience to lower her clients' tax liabilities and also shield their interests.Tax obligation regulations transform frequently, and many people and also entrepreneur are merely unaware of the myriad of rules that regulate deductions, credit scores and also reportable revenue. Because of this, the average taxpayer might make mistakes that can result in the underpayment or over repayment of tax obligations. If the taxpayer underpays his taxes, he might be subject to an internal revenue service audit, with possible penalties.

A tax working as a consultant is a service that offers expert recommendations to tax filers. A great tax specialist recognizes tax obligation laws, and also has the ability to advise strategies that minimize responsibilities while likewise decreasing the opportunity of an audit that can cause a problem with the internal revenue service or with a state tax obligation agency.

The Definitive Guide to Federal Tax Preparation

A tax preparer is a person that prepares income tax forms, such as the 1040 or 1040 EZ, for others. The trade is freely regulated: tax obligation preparers generally complete a brief training program, register with the IRS to receive a tax obligation preparer number, and, in some states, need to sign up with the state agency before starting job. click to find out more.

Aiding customers with tax obligation concerns during and also after a considerable life change, such as a marital relationship, divorce, fatality of a partner or birth of a youngster. Completing intricate tax types and also schedules that a lot of tax obligation preparers are not familiar with. Standing for a client in negotiations with the IRS or other tax collection companies.

Below are some common demands for coming to be a tax consultant: More hints Becoming a tax preparer normally only requires finishing a brief training course. Some states, such as The golden state, call for tax obligation preparers to complete a training course authorized by the regulatory company that signs up or accredits preparers. People who have an interest in a profession as a tax specialist must ask their state's regulatory body to supply them with a checklist of authorized training course carriers (see post).

The Definitive Guide for Tax Defense

Programs funded by private companies might be absolutely free or require only the purchase of some books. In a lot of cases, individuals that succeed in these courses might be offered employment by the tax obligation prep business. An additional option for those who have an interest in tax obligation preparation as an occupation is to come to be an IRS Tax Volunteer.